Caisse d’Epargne Nederland Corporate & Investment Banking

The regional cooperative bank belonging to its customers

Who we are?

A branch of Caisse d’Epargne Hauts de France

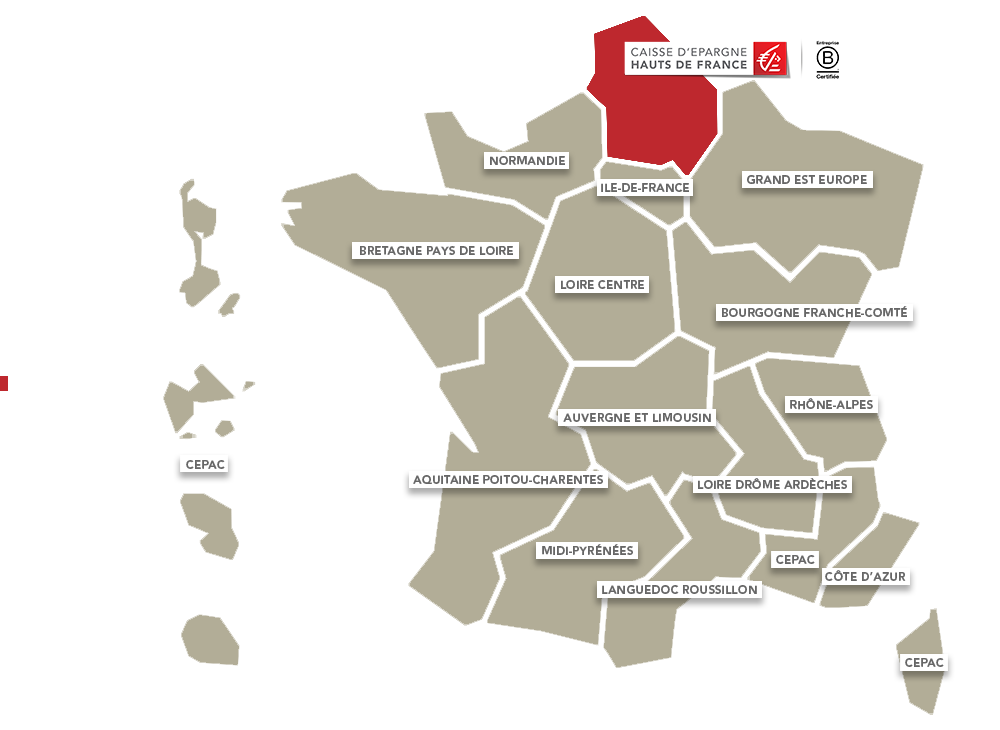

One of the 15 Caisse d'Epargne

Firmly rooted in their local communities, the Caisses d’Epargne

pursue their missions day after day…

To be useful to everyone, without ever losing sight of the collective interest.

A cooperative bank, strongly established regionally

• 3 000 staff serving clients, individuals, corporates, institutionals, associations

• 300 branches

• 9 business centers across the territory

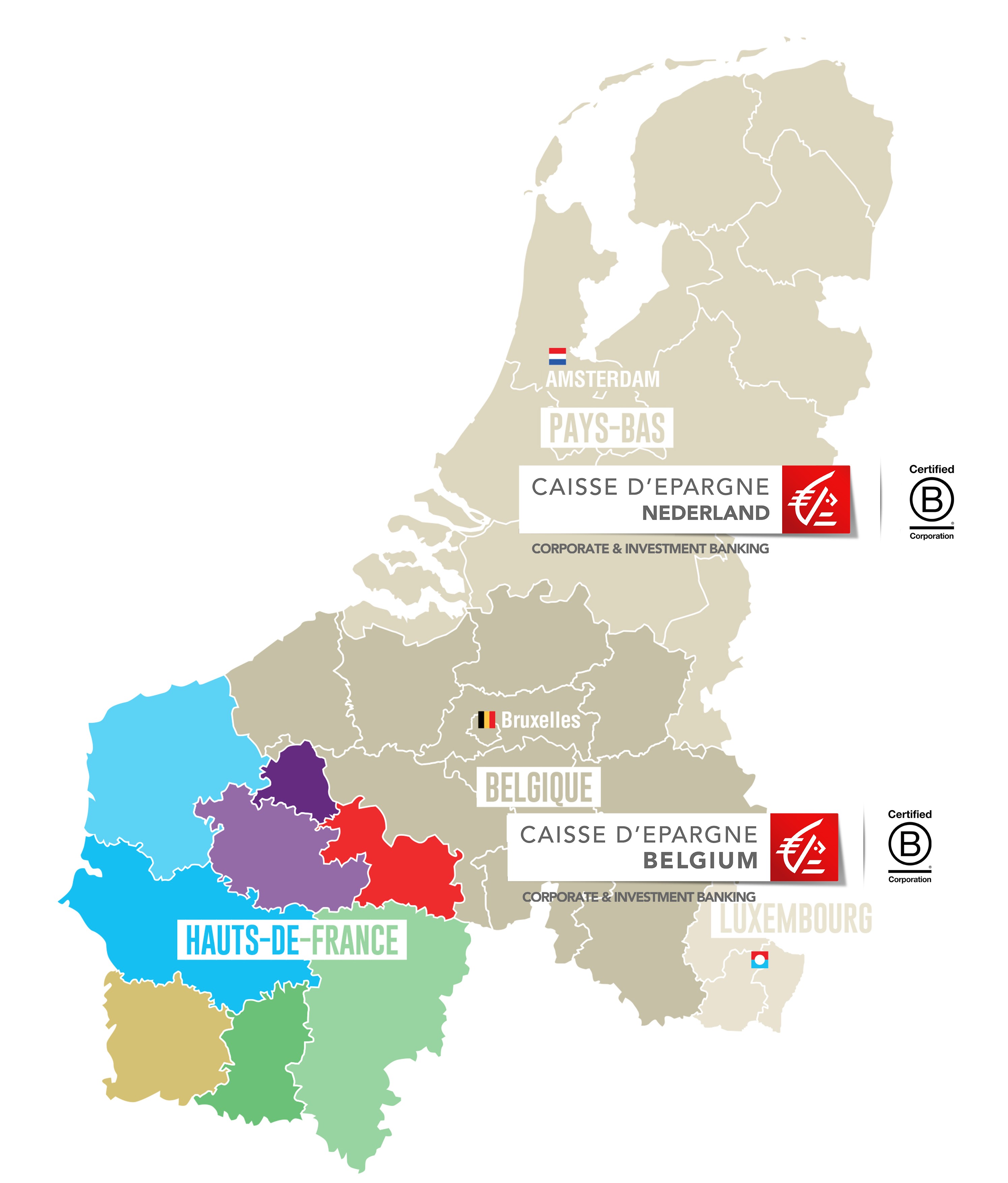

Expanding towards the benelux countries

The Caisse d’Epargne Hauts de France is pursuing a long-term development in Benelux since 2014, to support corporate and real estate players.

- A 9 corporate bankers team to serving our corporate and real estate clients since 2014

- 140 clients

- +48 NPS

Capitalizing on our solid presence and our successes in Belgium, we are continuing our development in Luxembourg and the Netherlands. We have reached a strategic milestone in the Benelux, a key project for Caisse d’Epargne Hauts de France

Caisse d’Epargne Hauts de France, a bank managed locally with 100% of its decisions taken on its territory

-

100% COOPERATIVE

Our cooperative model allows us to act in the general interest by adopting a long-term vision. And as a cooperative bank, we have no other interests to serve but yours.

-

100% REGIONAL

We make decisions at local level that impact the heart of our region.

€6.2bn of loans granted to companies and institutions on our territory in 2024.

€2bn of debt arranged (for company acquisitions and transmissions, renewable energy and infrastructure projects, etc..) in 2024. -

100% USEFUL

For the economic, social and environmental development of our region.

We support environmental and societal transformations in our region. We have been B Corp certified since 2022.

8th bank certified B Corp in Europe.

A solid bank, close to its customers and territories

-

€687m

Net banking income

-

€47bn

Loans in progress

-

€160m

Net income

-

23,7%

CET1 solvency ratio

Regulatory threshold: 10.47%

Part of BPCE Group

4th largest banking group in Europe & 2nd largest banking group in France

Among top players in Europe, offering a full range of expertise

Non-listed companies

• Our priority: serving our clients and the public interest

• Continuous strengthening of our financial stability and lending capacity

Banks that belong to their clients

• Managed locally, in close connection with their directors elected by the member clients

• Customer satisfaction placed at the heart of their DNA

Large set of expertise

Universal “Bankinsurer”

• 100 000 employees in 50 countries

• Covering the entire banking and insurance services scope

Among European and global leaders

• 2nd European largest asset manager

• 2nd largest bond issuer in the world

Our offering in Netherlands

A broad range of products for your business

-

Flow and cash management

• Current account (IBAN NL)

• Online banking (ISABEL)

• Term deposits

• Investment products (structured products and UCITS) -

Global Markets

• Trading room: Forex, interest-rate and commodity hedging

• Equity Capital Markets: IPOs, capital increases, share buybacks, convertibles

• Debt Capital Markets -

International

• Documentary credits

• International guarantees

• Import/export letters of credit

-

Financing

• Short term (treasury facilities) • Medium/Long term (fixed or variable rate loans, RCFs)

• Acquisition finance (syndicated loan arranger or participant)

• Equipment leasing (green/solar leasing)

• WCR financing (factoring)

• Structured finance

-

Advisory

• Natixis Partners: M&A and LBO advisory

• Pramex International: Foreign investment project advisory -

Cross-border

• Support from subsidiaries in France

Our team

Derk Graver

Head of Nederland

derk.graver@caisse-epargne.nl

Alexander Marquenie

Senior Corporate banker

alexander.marquenie@caisse-epargne.nl

Stijn van Meersbergen

Senior Corporate Banker

stijn.van-meersbergen@caisse-epargne.nl